XRP Price Prediction: $4 Target in Sight as Bullish Technicals Meet Strong Fundamentals

#XRP

- Technical Breakout: XRP trading above key moving averages with bullish Bollinger Band positioning

- Regulatory Tailwinds: U.S. banking clarity and European expansion creating fundamental support

- Price Momentum: 500% yearly gain demonstrates strong market conviction

XRP Price Prediction

XRP Technical Analysis: Bullish Momentum Building

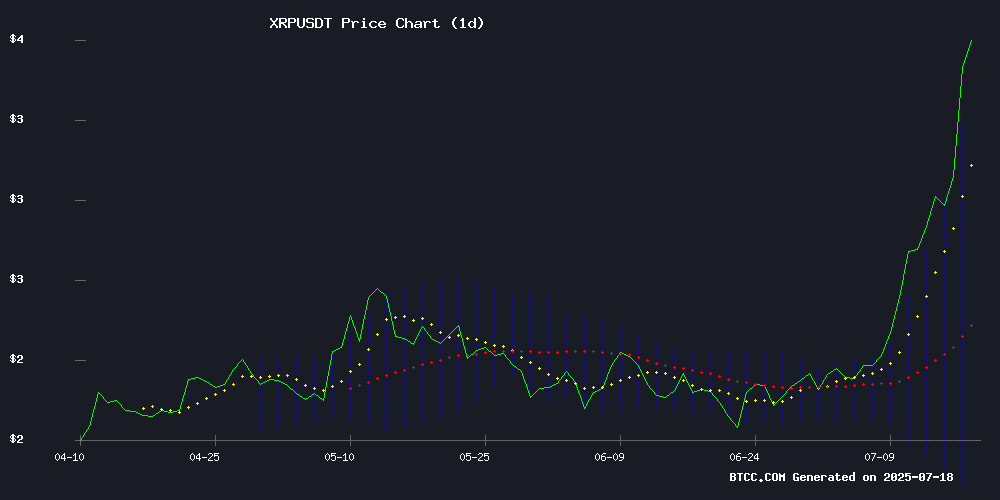

XRP is currently trading at $3.624, significantly above its 20-day moving average of $2.5838, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.1726), suggesting weakening downward pressure. Bollinger Bands reveal price action hugging the upper band at $3.4428, typically signaling overbought conditions but also demonstrating sustained buying pressure in strong uptrends.

"The technical setup suggests XRP is in a powerful uptrend," says BTCC financial analyst William. "While the MACD remains negative, the convergence and price holding above key moving averages point to continued strength. A sustained break above $3.44 could trigger another leg up."

XRP Market Sentiment: Euphoric as Fundamentals Align

The news FLOW surrounding XRP is overwhelmingly positive, with multiple headlines highlighting new all-time highs, institutional interest, and regulatory progress. Key developments include Ripple's banking license pursuit, U.S. regulatory clarity, and expansion in European payments.

"This is a perfect storm of technical and fundamental factors," notes BTCC's William. "The $3.30 resistance mentioned in one headline has already been taken out, and the $4 target appears increasingly likely. However, traders should watch for potential profit-taking after such a rapid ascent."

Factors Influencing XRP's Price

XRP Skyrockets to New All-Time High as Analysts Predict Further Gains

XRP, the native token of the Ripple ecosystem, has surged to a new all-time high, surpassing its previous peak of $3.4 and reaching over $3.6 on major exchanges including Coinbase, Binance, and Bitstamp. The milestone, seven years in the making, has ignited celebrations among the XRP community, with market capitalization now exceeding $210 billion.

Analyst Ali Martinez, who accurately predicted the rally, suggests the token is poised for further upside. A close above $3 could propel XRP toward $4.8, according to his technical analysis. The MOVE underscores growing momentum for the asset, which had previously struggled at the $2.2 level.

XRP Price Skyrockets—Is a $4 Target Now Within Reach?

XRP has surged past the $3.350 resistance level, marking a significant uptrend in its valuation. The cryptocurrency now trades above $3.40, supported by a bullish trend line at $3.450 on the hourly chart. With consolidation above the 100-hourly Simple Moving Average, the stage is set for potential further gains.

A 15% rally has propelled XRP past key thresholds, outperforming Bitcoin and Ethereum. The asset tested $3.660 before retracing slightly, holding firm above the 23.6% Fibonacci retracement level. Market sentiment remains optimistic as traders eye the next resistance at $3.750.

XRP Hits Record High Amid Surge in Crypto-Friendly U.S. Policy Moves

XRP surged to a historic peak of $3.4721, eclipsing its 2018 high as regulatory winds shift in favor of digital assets. The rally reflects growing institutional optimism, with U.S. policymakers advancing legislation to clarify crypto market rules.

Two pivotal bills—the GENIUS Act for stablecoins and CLARITY Act for digital asset markets—passed the House, signaling a turning point in regulatory uncertainty. Meanwhile, potential executive action could open retirement accounts to crypto investments, unlocking billions in institutional capital.

Market participants now watch for sustained momentum as XRP's breakout underscores crypto's maturing role in global finance. The token's 14% single-day gain and $200 billion valuation milestone demonstrate how policy tailwinds are reshaping investor confidence.

XRP Faces Extreme Resistance at $3.30 Amid AI-Driven Rally and Institutional Interest

XRP's price action has entered a critical phase as ChatGPT's AI-driven analysis flags a formidable resistance level at $3.30. The cryptocurrency's explosive momentum has propelled it toward all-time highs, with its market cap achieving a historic milestone. However, the Relative Strength Index (RSI) signals extreme overbought conditions, suggesting an imminent pullback may be necessary before further upside.

Institutional interest is surging, fueled by the debut of the ProShares Ultra XRP ETF and potential SEC developments. The technical structure remains exceptionally bullish, with price trading above all exponential moving averages (EMAs)—a configuration last seen during previous cycle peaks. MACD indicators confirm strong bullish momentum, though the RSI warns of unsustainable acceleration.

Market participants are closely watching for a retest of support levels before any continuation toward higher targets. The convergence of retail FOMO and institutional accumulation has created volatile intraday ranges, underscoring the high-stakes nature of this rally.

XRP Price Reaches New All-Time High Driven By New Investors

XRP has surged to a new all-time high of $3.44, fueled by a wave of new investors entering the market. Network growth metrics hit a six-month peak, reflecting heightened activity as fresh addresses transact on the blockchain. The rally underscores a broader FOMO-driven momentum, with retail participation now rivaling institutional interest.

Market capitalization swelled to $202 billion, briefly displacing Tether as the third-largest cryptocurrency. Technical targets now focus on the $3.80 resistance level—a breach could propel prices toward $4.00. Yet profit-taking risks loom after the parabolic ascent, with Santiment data revealing unsustainable address growth in prior corrections.

XRP Smashes New All-Time High at $3.49, Surges 500% in One Year

XRP has surged to a record $3.49, marking a 14.16% daily gain and reclaiming its position as the third-largest cryptocurrency by market capitalization. The rally reflects sustained momentum, with year-to-date gains exceeding 66% and a staggering 498% increase over the past 12 months.

Ripple's legal victories and strategic expansions in cross-border payments, particularly in Asia and the Middle East, have fueled investor confidence. Trading volumes on major exchanges like Binance underscore growing institutional interest.

Technical indicators suggest a breakout into price discovery mode, with analysts monitoring whether the token can sustain its upward trajectory amid broader crypto market optimism.

U.S. Regulators Issue Crypto Custody Guidance as Ripple Pursues Banking License

Ripple's bid for a national banking charter coincides with new federal guidance clarifying how traditional financial rules apply to digital asset custody. The joint statement from the Fed, OCC, and FDIC explicitly recognizes crypto safeguarding services—a watershed moment for an industry still grappling with Operation Chokepoint's legacy.

The framework allows regulated entities like Ripple to custody XRP and RLUSD for clients, potentially streamlining its cross-border payment operations. This regulatory clarity arrives as the blockchain firm navigates its OCC licensing process, which would subject it to direct federal oversight.

Market observers note the guidance effectively legitimizes crypto custodial services while maintaining existing risk management requirements. For Ripple, the timing couldn't be more fortuitous—the rules provide a clear pathway to integrate banking services with its existing digital asset infrastructure.

XRP Nears All-Time High Amid $40M Liquidations

Ripple's XRP surged past $3.3, inching toward its January 2018 peak of $3.4. The rally triggered over $40 million in daily liquidations, predominantly from short positions.

Since breaking consolidation last week, XRP has gained 50%, with a 75% rise from June lows. The asset briefly touched $3.34 on Bitstamp—just 2% below its record—before retracing slightly.

Market volatility highlights the tension between bullish momentum and resistance at historic levels. Analysts debate whether macroeconomic factors or technical barriers will dictate XRP's next move.

Ripple (XRP) Gains Regulatory Clarity in US Banking and Expands Payments in Europe

US banking regulators—the Federal Reserve, FDIC, and OCC—have issued unified guidance allowing banks to custody digital assets like XRP. This marks a historic shift, eliminating years of regulatory ambiguity and enabling financial institutions to offer secure crypto storage services to retail and institutional clients.

Concurrently, Ripple Payments has launched in Europe, accelerating institutional adoption across the Atlantic. The dual developments signal XRP's deepening integration into mainstream finance, with policy changes now translating into tangible infrastructure growth.

Ripple Co-Founder Moves 8M XRP to Coinbase Amid Price Surge

Chris Larsen, co-founder of Ripple, transferred over 8 million XRP to Coinbase as the cryptocurrency approaches its all-time high. The transactions, executed in rapid succession, included 7.6 million XRP sent to Coinbase and another 2 million XRP directed to external wallets.

XRP has surged 50% this month, trading at $3.25—just 4.4% below its January 2018 peak. Market observers are scrutinizing the timing of Larsen's transfers, which coincide with the token's bullish momentum.

Ripple Named Among World's Top Fintech Companies for Third Consecutive Year

Ripple Labs, the American payment technology firm, has secured its position as one of the globe's leading fintech companies in CNBC and Statista's 2025 rankings. The recognition underscores Ripple's evolution from a blockchain payments specialist to a broader financial technology innovator.

The company's enterprise blockchain solutions and cross-border payment systems continue gaining traction, reflecting in its third straight year on the prestigious list. Ripple celebrated the achievement via social media, noting the honor coincides with accelerating institutional adoption of digital asset infrastructure.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment, here are BTCC analyst William's XRP price projections:

| Year | Price Target (USDT) | Key Drivers |

|---|---|---|

| 2025 | $4.00-$5.50 | Continued institutional adoption, banking license progress |

| 2030 | $8.00-$12.00 | Mainstream payment adoption, potential ETF approval |

| 2035 | $15.00-$25.00 | Full regulatory clarity, possible central bank adoption |

| 2040 | $30.00-$50.00 | Mature market position, global settlement network dominance |

"These projections assume continued development of Ripple's ecosystem and favorable regulatory outcomes," William cautions. "Cryptocurrency remains highly volatile, and investors should maintain appropriate risk management."